Google adsense、Admob、Youtube 收款超过5万美金的收款结汇攻略

2021.11.23 发布

2023.08.03 修复

, Admob, Youtube Receipt and Settlement Strategies for Receiving Payments Over US$50,000

The US$50,000 in foreign exchange control limits foreign exchange settlement, not collection. So when your annual payment exceeds 50,000 US dollars, you can still receive the money to the bank card normally. Only the USD on the card will not be able to settle foreign exchange because your settlement limit is not enough.

Here are 4 solutions that you can choose according to your specific situation. The 4 schemes are sorted by income amount from lowest to highest.

1. Suggested annual collection amount for transfer to relatives for foreign exchange settlement: 50,000-60,000 US dollars can be processed at the bank counter, the US dollars will be transferred to the relative’s account, and then foreign exchange settlement will be made through the relative’s account.

Take China Merchants Bank as an example: 1) Which relatives can be: direct or close relatives. Like parents, children, grandparents, grandparents and grandparents.

2) Bring documents: personal ID card, bank card, relative's ID card, relative's bank card, relative certificate (such as marriage certificate, household registration book).

3) You can do it at the counter of your bank, and your relatives do not need to be present.

4) It is recommended that some banks call to confirm which outlets can handle it, and not all outlets can handle it.

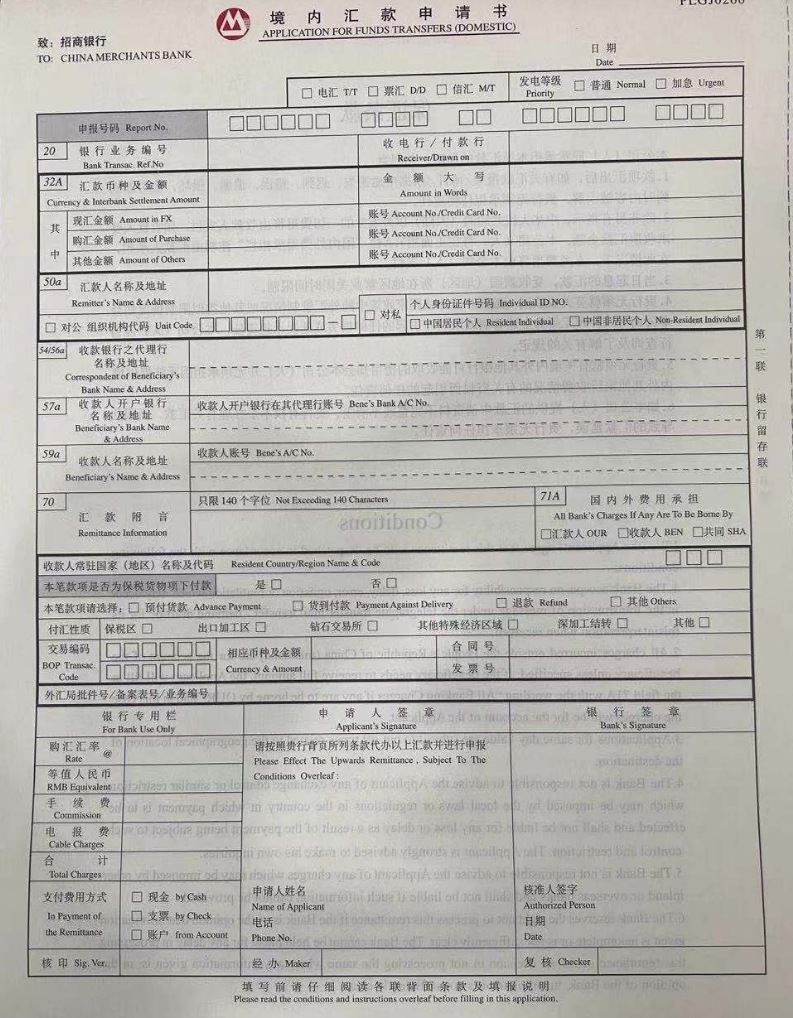

After arriving at the bank, you just fill in the form and submit your credentials at the counter for processing. The processing time is about 15 minutes. The figure below is the form that needs to be filled out.

There is a problem with this approach.

This method of operation is called "split settlement" under the foreign exchange control system. If the remittance is transferred to multiple relatives, it may be classified as "split settlement" and be included in the settlement blacklist, which may affect the normal settlement of foreign exchange in the future. .

2. Replace the back-end payee. Suggested annual payment: 60,000 to 200,000 US dollars. Choose the back-end to add the payee. Everyone who has received the payment should be fine. The payee can be added and replaced.

If the original beneficiary's annual foreign exchange settlement is close to the upper limit, it can be replaced with a new beneficiary and beneficiary account in advance. In this way, from the next payment date, Google will pay to the newly replaced payee account. After that, you can settle the exchange through the new beneficiary account.

If you don’t know how to receive money by wire transfer, you can read this "Guidelines for Domestic Wire Transfer Receipt".

3. The recommended annual payment amount for the settlement of the Hong Kong card: 200,000 + USD. Friends who have investment experience in US stocks and Hong Kong stocks should already have an understanding of the Hong Kong card. That is, open a bank card in a bank in Hong Kong and link it to a bank account in the Mainland. Because Hong Kong is currently not subject to the US$50,000 foreign exchange control, foreign exchange can be settled through Hong Kong's bank card.

At this stage, it is not convenient to open an account in Hong Kong due to the epidemic. We recommend the Minsheng Bank Hong Kong Card and China CITIC Bank Hong Kong Card, both of which can witness account opening in the Mainland at a low threshold.

There will be a certain annual fee and handling fee for the use of the Hong Kong card.

本文是针对中国大陆用户Google Adsense、Admob、Youtube收款金额超过5万美金,受到外汇管制限制时的收款及结汇攻略。

外汇管制的5万美金限制的是结汇,不是限制收款。所以当你的年度收款超过5万美金时,仍然可以正常收款到银行卡。只是卡上的美元,会因为你的结汇额度不够而无法结汇。

在这里分享4种解决方案,大家可以根据具体情况进行选用。4个方案按收入金额从低到高排序。

1、转账给亲属结汇

建议年收款额:5-6万美金选用

到银行柜台办理,将美元转账到亲属账户,再通过亲属账户结汇。

以招商银行为例:

1)哪些亲属可以:直系、近亲都可以。像父母、子女、爷奶、外公外婆都可以。

2)携带证件:本人身份证、银行卡、亲属身份证、亲属银行卡、亲属关系证明(如:结婚证、户口本)。

3)本人银行柜台办理,亲属不用到场也可以。

4)建议先些银行电话确认哪些网点可以办理,并非所有网点都可办理。

到银行后,就是填表、到柜台提交证件办理,办理时长约为15分钟。下图是所需要填写的表格。

这种方式,有一个问题。

这种操作方式在外汇管制制度下被称为“分拆结汇”,如果转汇给多个亲属,可能会被界定为“分拆结汇”而被列入结汇黑名单,可能影响以后的正常结汇。

2、更换后台收款人

建议年收款额:6-20万美金选用

后台添加收款人,大家收过款的应该都会了。这个收款人,是可以添加和更换的。

如果原收款人年度结汇额已经接近上限时,可以提前更换为新的收款人和收款账号。这样从下次付款日起,Google会支付到新更换的收款人账号。之后可以通过新的收款人账号结汇。

不知道怎么电汇收款的可以看这篇《国内电汇收款攻略》。

3、香港卡结汇

建议年收款额:20万+美金选用

有美股港股投资经验的朋友,应该已经对香港卡有所了解。即在香港的银行开办一张银行卡,与内地的银行账户关联起来。因为香港目前不受5万美元的外汇管制,可以通过香港的银行卡结汇。

现阶段因为疫情原因也不方便到香港本地去开户。在这里推荐民生银行香港卡、中信银行香港卡,这两种卡都可以低门槛的在内地见证开户。

香港卡使用会有一定的年费、手续费,要办就先整明白了,确定自己需要了再办。

4、更换为公司账户收款

建议年收款额:20万+美金选用

通过公司账户收款,就不受个人外汇的5万美元限制了。也免去了频繁更换收款人的麻烦,同时也解决了,月收入超过5万美元的痛苦。但注册成立和维护一家公司,也需要额外的成本支出。

另外,还有义务个人户、重庆渠道,在这就不做主要推荐了。当然还可以到银行柜台提供相关Google合作的收入真实性证明材料,办理个人结售汇业务。但这需要联系Google官方提供相应合同,并且每次都要跑银行结汇,稍微复杂些不做主要推荐。

Google付款的几个关键日 详情请看第二页!

- 内容分页 1 2