4 月 3 日消息,中国证券报称,华为现在又一次杀入了新的领域,而且这次还是大家熟知的移动支付行业。

On April 3, the China Securities Journal said that Huawei has now entered a new field again, and this time it is the well-known mobile payment industry.

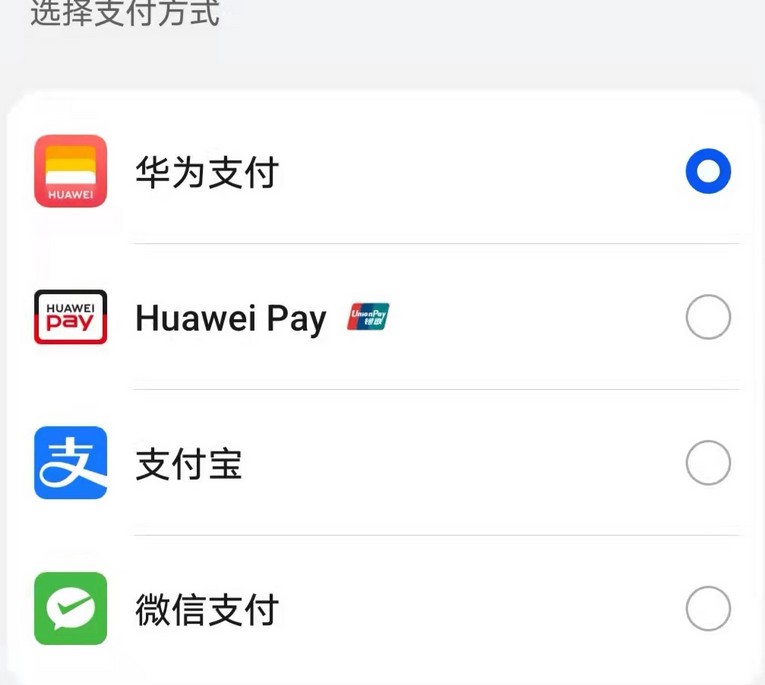

According to industry insiders, Huawei Pay has been online for several months and is being promoted. Huawei Pay has covered Huawei applications and some third-party applications, including Huawei Music, Huawei Video, Huawei Reading, Mango TV, Youdao Cloud Notes, PP Video, etc.

Huawei Pay

Huawei Pay is a payment service provided by "Shenzhen Xunlian Zhifu Network Co., Ltd." approved by the People's Bank of China.

Huawei Pay relies on Huawei Wallet as the management portal to provide individual users with services such as balance payment, bank card payment, red envelopes, recharge, and cash withdrawal; it also provides corporate users with rapid integration of payment capabilities, and provides services such as fund settlement, automatic account splitting, and marketing empowerment.

Huawei Pay is committed to providing users with payment-related services, connecting a richer digital life, and creating a safer and more convenient all-scenario smart experience.

It is reported that "Huawei Pay" has now appeared on the homepage of Huawei Wallet. You can click on Huawei Pay in Huawei Wallet to see that you can enjoy instant discounts when paying with a bank card for the first time in some apps. At present, Huawei Pay has been launched and supports binding to more than 160 banks.

Huawei Wallet

In August 2016, Huawei Pay was launched in Huawei Mate and Honor series smartphones, marking Huawei's official entry into mobile payment, but Huawei had no plans to apply for a payment license at that time.

In addition to Huawei Pay, Huawei has also launched mobile POS and Huawei Card, a co-branded credit card jointly launched by China CITIC Bank, Huawei and UnionPay.

On the second anniversary of the launch of Huawei Pay, Huawei officially stated that the number of Huawei Pay cards issued in that year increased by 300% year-on-year, the number of transactions increased by 350%, and the number of transactions increased by 400%. When third-party institutions such as WeChat and Alipay settle transactions for merchants, the latter need to pay a handling fee of 0.6% to 1%.

This means that Huawei needs to pay high handling costs. In this case, it is particularly important for Huawei to launch its own payment channel. It is worth mentioning that Su Jie, President of the Consumer Cloud Service Department of Huawei Consumer BG, has also stated many times before that Huawei will not apply for a payment license. He believes that an enterprise must have its own boundary awareness.

Therefore, Huawei won the third-party payment license on March 25 last year to clear the way for entering the payment field (the third-party payment company Shenzhen Xunlian Zhifu Network Co., Ltd. "Xunlian Zhifu" has undergone industrial and commercial changes, and Huawei Technologies Co., Ltd. The company became the sole shareholder of Xunlian Zhifu).

有业内人士透露,华为支付已经上线数月,正在进行推广。华为支付已覆盖华为系应用和部分第三方应用,包括华为音乐、华为视频、华为阅读、芒果 TV、有道云笔记、PP 视频等。

华为支付

华为支付是经中国人民银行许可,由“深圳市讯联智付网络有限公司”提供的支付服务。

华为支付依托华为钱包为管理入口,为个人用户提供余额支付、银行卡支付、红包、充值、提现等服务;并为企业用户快速集成支付能力,提供资金结算、自动分账、营销赋能等服务。

华为支付致力于为用户提供支付相关服务,连接更丰富的数字生活,打造更安全、更便捷的全场景智慧体验。

据悉,目前“华为支付”已出现在华为钱包首页上。你在华为钱包内点击华为支付可以看到在一些应用首绑银行卡支付可享立减优惠。目前华为支付已经上线并支持绑定 160 多家银行。

华为钱包

2016 年 8 月,华为支付(Huawei Pay)在华为 Mate、荣耀系列智能手机中上线,标志着华为正式进军移动支付,但华为彼时却并没有申请支付牌照的计划。

除华为支付外,华为后续还推出了手机 POS、Huawei Card—— 中信银行、华为与银联共同推出的联名信用卡。

华为支付上线两周年时,华为官方表示当年 Huawei Pay 发卡量较第一年同比增长 300%,流水增长 350%,交易笔数增长 400%。而微信、支付宝等第三方机构为商家进行交易结算时,后者需支付 0.6%~1% 的手续费。

这意味华为需要支付高额的手续费成本。在这种情况下,华为推出自己的支付渠道就显得尤为重要。值得一提的是,华为消费者 BG 消费者云服务部总裁苏杰此前也曾多次表态,称华为不会去申请支付牌照,他认为一个企业必须有自己的边界意识。

因此,华为在去年 3 月 25 日拿下第三方支付牌照,为进军支付领域扫清障碍(第三方支付公司深圳市讯联智付网络有限公司“讯联智付”发生工商变更,华为技术有限公司成为讯联智付唯一股东)。